By Tom Bradley

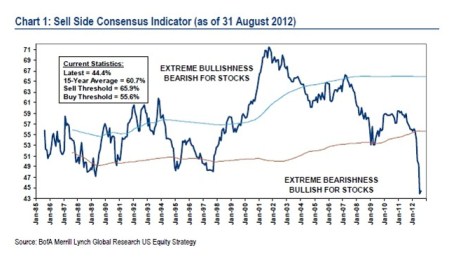

There was an article by David Berman in the Report on Business yesterday pointing out how bearish Wall Street strategists are these days (Time to Buy as Pros Turn Bearish). As a group, their recommended stock weighting is 44.4%, which is near its lowest level since 1985. This compares to a long-term average of 60-65%.

In the article, Mr. Berman asks whether this is a bullish indicator for the market? For Savita Subramanian, the head of U.S. equity and quantitative strategy at Bank of America, the answer is yes. She points out that when the indicator has been below 50, the market over the next 12 months has been positive 100% of the time.

I talk a lot about market sentiment in this space. It’s the third element of any analysis I do (after fundamentals and valuation). For any investor, it’s a good check and balance. When everyone is bearish, the downside risk is more limited because most of the distressed selling has been done. If the fundamentals and valuation are reasonable, it’s a time to have a bias towards buying, not selling. As Ms. Subramanian notes, however, the market’s mood is just one of many indicators investors should look at.

So where was the strategist indicator in 2009 when the market went on one of the great runs of all-time? As you can see from the chart (source: BofA Merrill Lynch), it was also showing the strategists were extremely bearish ... which of course is bullish.