By Tom Bradley

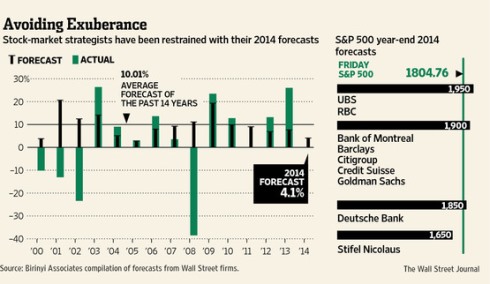

There was a telling chart in last weekend’s Wall Street Journal. It showed the market predictions of Wall Street strategists for each year going back to 2000 (see below).

The chart shows no discernable pattern or trend that would imply that the predictions are in any way useful. There were a few years where the actual return of the S&P 500 was close to the forecast, but it appears to be totally random. Of note, the forecasts were all positive, including the years when the U.S. market had a large negative return (2000, 2001, 2002 and 2008).

While the chart is damning, it doesn’t discourage me from following particular strategists. Embedded in a single point forecast is often some useful insights about market fundamentals – interest rates, profits and valuation, to name a few. In this regard, I often reference the strategy work done by GMO, a Boston-based asset manager, and Connor, Clark & Lunn Investment Management, the manager of our Income Fund.

But the biggest mistake strategists make is providing 1-year forecasts in the first place. Presumably, amongst the brainpower and technology that goes into generating the estimates, someone (or some statistical model) would stand up and declare that it’s futile to call the market over short periods of time, including 1 year. I know market calls are the lifeblood of the sell side of the street (brokerage) and the media, but strategists need to know that every time they make a short-term prediction, they’re doing a disservice to their clients … and their reputations.

My response to this issue is to never make short-term market calls. I started the practice years ago when I was at PH&N. When the pension consultants asked for our 1-year forecasts each December, we politely refused.

At Steadyhand, we’re still saying “I don’t know” when people ask where the market is going. What we do provide, however, is a 5-year projection of what we think stock market returns will be. It’s always a range (i.e. a rough estimate), which takes into account dividend yields, the outlook for profit growth and stock valuations (price to earnings multiples). It has moved around between 5-7% per annum (the current forecast) and 7-10% (spring 2009; fall 2011). It’s this projection, along with other factors like interest rates, which help shape our advice to clients and the allocations in the Founders Fund.

The next time you hear someone making a short-term market call, take it with a huge grain of salt. The logic and thinking behind the forecast may prove out over the medium to long term, but it has no predictive value for the time frame being referred to.