By Tom Bradley

The Canadian and U.S. central banks are good at finding a reason why they shouldn’t increase interest rates. There’s always a statistic or economic event that is used to remind us how fragile the economy is.

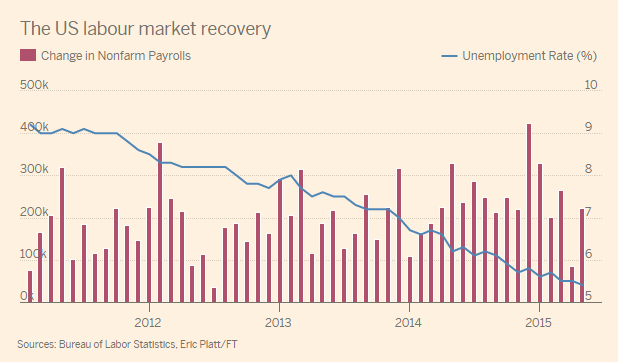

Meanwhile, auto sales are robust, housing markets are strong (insane in some parts of Canada) and if you look around on the subway or at the grocery store, there are very few cell phones older than two years. The U.S. is approaching full employment (see chart below) and experiencing labour shortages in some fields. And to boot, we have lower energy prices than we’ve had in years.

I’m not sure what the central banks are waiting for. Perfection is not attainable. The growth rates of the debt-induced 80’s and 90’s are not attainable.

After 70 months of economic recovery in North America, it’s time to forget about short-term micro-managing and start to put a little hay in the loft for the next difficult period. Going into an economic slowdown with near-zero interest rates is a scary prospect.

Note: The last time I expressed this view, the Bank of Canada lowered the key lending rate within a couple of days. Readers should be prepared for a rate cut sometime next week.