By Scott Ronalds

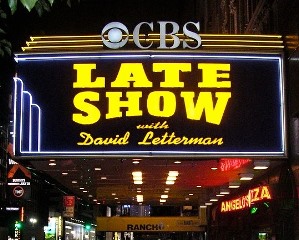

David Letterman is a late night institution. He’s been on the air for nearly 33 years, making him the longest-tenured late night talk show host in U.S. history.

Dave’s long been a favourite of mine (and I was lucky enough to see his show live). His timing, irreverence and sketches are brilliant. But even I’ll admit that he’s been slipping in recent years. He’s hanging it up this week, with his last show on Wednesday. Dave concedes that the audience is changing and what he’s doing “is not what you want at 11:30 anymore.” The Jimmys (Fallon and Kimmel) are the new innovators and are winning over the late night set.

This changing of the guard is nothing new. It happens all the time in entertainment and business. In our industry, it’s imminent. New regulations that come into effect next summer will require all fund providers to show their clients what they’re paying for advice, and how their accounts have performed. (It’s shocking that most firms don’t do this already!) It will be a wake-up call for many Canadians who have been kept in the dark on fees and performance.

Many companies are scrambling. Innovation will come. We’re already seeing the emergence of “robo-advisors” and the term fintech (financial technology) is entering the vernacular. It’s interesting times. Will commission-sold funds go the way of Letterman? How will the banks react?

As a firm, we’re excited. We invite transparency and are all over helping Canadians become better investors. And we’re always looking for ways to improve our business and challenge the status quo.

May 20th will mark the end of an era in late night TV. Here’s hoping next summer will mark the end of an era in investment management.