by Scott Ronalds

A few numbers stood out while I was reviewing last quarter’s returns.

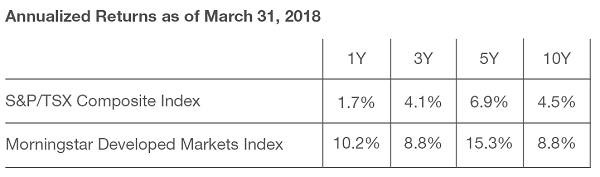

Canadian stocks (as measured by the S&P/TSX Composite Index) are up less than 2% over the past year. Go back three years and they’re up 4% (per year). Five years looks better, at almost 7%, but over the past decade, the number drops back down to 4.5%.

It hasn’t exactly been the best of times for investors who stick close to home. Global stocks, on the other hand, have been the place to be. The Morningstar Developed Markets Index (a broad gauge of global stock returns) is up 10% over the past year, 9% over the last three years (per year), 15% over the past five years, and 9% over the past ten (all figures are in Canadian dollar terms).

What gives? It simply comes down to the fact that our market isn’t very well diversified. Its composition is top heavy, with resource companies and financial services each making up one-third of the index. The energy and mining sectors have been the two worst performing industries over the past decade (down 4% per year and 3%, respectively). Commodity-related companies used to comprise an even larger slice of the TSX, but their weak performance in recent years has seen their weight come down.

Technology and consumer-related companies have been among the best performing stocks worldwide, but the Canadian market has minimal exposure to these sectors.

Equity-oriented investors at Steadyhand have done much better than those with a Canada-only portfolio that tracks the index. A big part of this has to do with our views on diversification, which we look at through three lenses.

-

Geographic: We own stocks from around the world, which also provides currency diversification.

- Industry: We don’t think it’s wise to focus on one or two industries, particularly highly-cyclical ones.

- Company size: We own small, mid and large cap companies.

As well, we don’t build and manage our funds with the index in mind. Canada is a great example of why.

The glass-half-full view of a lagging market is that it can offer better opportunities than its peers. Is this currently the case with Canada? We think so. Our managers are finding some interesting opportunities at home (recent purchases include Evertz Technologies and Uni-Select), and because of that, the Founders Fund has a higher weighting in Canadian stocks relative to foreign stocks than it’s had in a while (its current breakdown is roughly 50/50).

Canada will eventually play catch-up and our clients will be there when it does, but we’re taking a steadyhand approach — which means we’re staying diversified, remaining mindful of valuations (the price we’re paying for companies relative to their profits), and building portfolios that look nothing like the index.

We're not a bank.

Which means we don't have to communicate like one (phew!). Sign up for our blog to get the straight goods on investing.