by Scott Ronalds

Back up slowly. Do not stare. Stay calm. There’s a bear trotting through the new economy.

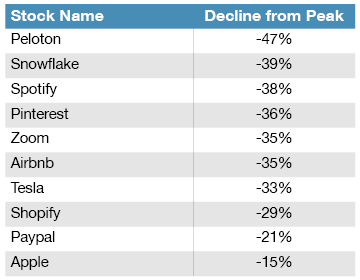

Many of last year’s hottest stocks — those that benefited the most from lockdown measures and the work-from-home movement — are taking it on the chin. Several are in bear territory now (i.e., they’ve seen a 20% fall from their peak), with some experiencing grizzly declines. Peloton has seen a 47% fall, Zoom’s off 35%, and Shopify, Canada’s e-commerce star, has dropped 29% from its high.

The list below highlights some of the damage (all figures as of May 12).

Chances are, you haven’t noticed the downfall or heard much about it. That’s because a balanced, diversified portfolio is doing just fine. Our Founders Fund is off a mere 2% from its 2021 high (as of May 12) and is up 2% for the year. It’s only portfolios that are heavy on ‘game changers’ and 'disruptor’ companies that are feeling the full impact. These stocks are largely in the tech space and, arguably, got ahead of themselves in the market rebound that started last spring.

I should note that not every tech-related company is in bear territory. Many of the mega-caps are holding up. Microsoft, Facebook, Amazon, and Alphabet have seen relatively modest pullbacks, while Apple is down 15%. Yet, these businesses have all reported blockbuster earnings recently but failed to impress investors. Clearly, expectations were high.

If you’ve got a well-balanced portfolio, you shouldn’t worry too much about these sector pullbacks and market intricacies. Time in the market and diversification are your best forms of bear spray.

[Management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The indicated rates of return are the historical annual total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns.]

We're not a bank.

Which means we don't have to communicate like one (phew!). Sign up for our blog to get the straight goods on investing.