by Tom Bradley

There are many who liken investing in stocks to going to the casino. I vehemently disagree (growing wealth by owning a diversified portfolio of companies is hardly gambling), but the tactics of many traders (I can’t call them investors) are indeed getting to be casino-like.

Investing is about reward and risk. The two find a balance over time but as 2025 starts, traders are heavily favouring the reward side. They can’t get enough of the strong stock market. The degree of speculation, in stocks and elsewhere, now rivals the go-go periods of 1999 and 2021.

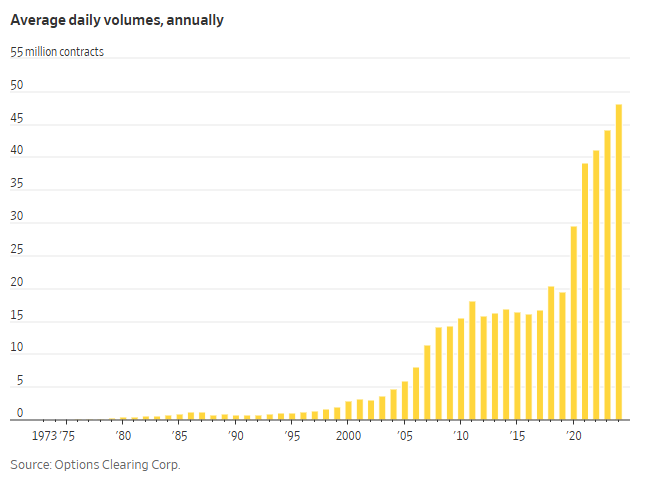

As I noted in a recent post, it shows up in crypto (the more exotic the better), artificial intelligence, the Trump Bump (everything he’s going to do will be great for stocks), stock valuations, Judy Garland’s ruby red shoes from The Wizard of Oz selling for $28 million, and as per the chart below which shows options trading volumes, the activity of individual investors (my apologies, I can’t remember the source).

It’s no longer enough to own a volatile stock. Active traders are looking for more leverage through the use of options. Volumes have gone through the roof, and that doesn’t tell the whole story. Most of the growth has come from same-day options which are closer to buying a lottery ticket or betting on Austin Mathews’ next goal than they are to investing.

When things get this hot, our fund managers tend to get more cautious. This doesn’t mean avoiding stocks but rather looking for opportunities in the unloved areas of the market, keeping an eye on the bottom line (company profits), being mindful of valuations, and staying well diversified.

We're not a bank.

Which means we don't have to communicate like one (phew!). Sign up for our Newsletter and Blog and join the thousands of other Canadians who appreciate the straight goods on investing.