By Tom Bradley

In our client presentations last month (a webinar version is available), we drilled into the stock holdings of the Founders Fund.

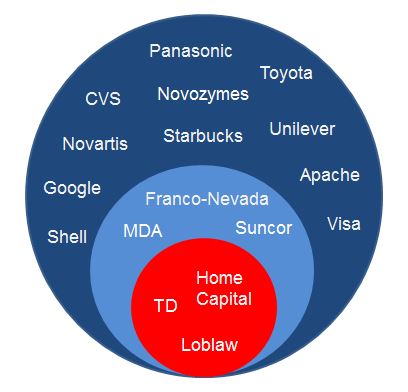

In the chart below, the full circle represents the overall stock weighting, which currently amounts to 66% of the Founders Fund. The second, light blue circle (30% of the total fund) reflects the companies that are headquartered in Canada and trade on the Toronto Stock Exchange. The red circle (16%) represents Canadian companies that are highly dependent on the domestic economy. In this category, we include the banks and other financial businesses, telcos, REITs and a number of other companies. (Note: the names in the circles are representative of their category. They do not constitute all the stocks in the fund.)

Canadian companies that have very little exposure to the domestic economy (light blue) include MacDonald Dettwiler (satellite manufacturer), Suncor and the other major oil companies, Thomson Reuters (media giant), Magna International (auto parts maker), Ritchie Brothers (auctioneer of industrial equipment) and a number of others.

The Founders Fund is a fund-of-funds, so the stocks are held indirectly through the Income, Equity, Global Equity and Small-Cap Equity Funds.

We did this breakdown because we wanted clients to understand their exposure to the Canadian economy, especially given the gloomy headlines we’re being barraged with.

Global ... local ... no matter where companies are headquartered, they’re subject to the same economic forces - interest rates, currencies, oil prices, China’s growth, etc. - but some are more impacted by local conditions than others.

Steadyhand clients should know that the global economic trends will be the primary drivers of their equity returns in the future, as opposed to Provincial and Federal government policies and/or the state of the highly-indebted Canadian consumer.