by Tom Bradley

With 2016 in the books, it’s a good time to look at how Steadyhand has done. In the review below, we look at our Founders Fund, which touches on everything we do. While not all our clients hold this fund, it is our largest fund and a good barometer of how we’re doing.

The Fund

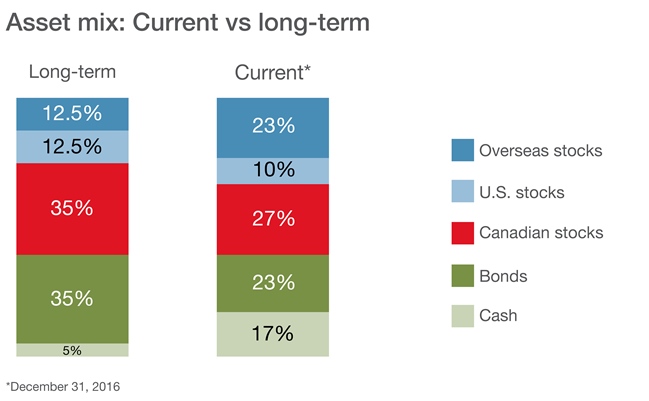

The Founders Fund is a diversified portfolio. It has exposure to a broad range of asset classes through its holdings in the other Steadyhand funds (it is a fund-of-funds). Its target asset mix is 60% stocks and 40% fixed income, although as Portfolio Manager, I have the scope to adjust the percentages.

Please note, the comments below effectively ‘look through’ the underlying funds held by the Founders Fund. For example, when I’m talking about bonds, I’m referring to the bonds held in the Income Fund.

For details on the underlying funds, I’d encourage you to go to our website or read our Q4 2016 Report that will be published next week.

Results

The Founders Fund has provided steady returns over its short history. To use a golf expression, it’s been good at ‘ham and egging it’ – when one part of the fund has been lagging, another has picked up the slack.

The fund’s performance record is one quarter shy of five years. Over this history, the results have been solid (8.1% per year since inception or a cumulative 46%) and in line with index returns. If I was to generalize, the fund had an excellent run in the first two years, but did not fully take advantage of the market opportunities in the last two plus years.

For 2016, the fund had a total return of 6.7%. For context, the Canadian bond market returned 1.7% (FTSE TMX Canada Universe Bond Index), Canadian stocks were up 21.1% (S&P/TSX Composite Index) and global stocks gained 4.9% (MSCI World Index $Cdn).

Strategies Impacting Fund Performance

A properly diversified portfolio has a variety of strategies at play and that certainly applies to the Founders Fund. Within that mix, three themes emerge as having the greatest impact on returns.

1. Overall stock allocation

-

When allocating capital, we’re always trying to have our largest exposures in asset types that have the highest return potential over the next five years. We’re not trying to time the ups and downs of the market or catch short-term trends.

- Since the summer of 2015 when the equity weighting was 55% of the total fund, we’ve been more active than usual. We were busiest during a three week period last January and February when we raised the percentage to 67% to take advantage of falling stock prices. Our clients benefited as equity markets rebounded sharply.

- The price recovery, however, have translated into higher price-to-earnings multiples. Stocks now look to be fully valued and our fund managers are again complaining about a lack of cheap stocks to buy. Since the spring, we’ve gradually brought the equity weighting back to 60% of the fund.

- We will continue to reduce our equity weighting if stocks trend higher.

Impact – Good short term. Slight negative long term.

In 2016, our shift towards stocks and some timely buying by the fund managers had a positive impact on the Founders Fund's return. Prior to the summer of 2015, however, the fund was generally too cautiously positioned with respect to stocks – i.e. not enough.

2. More foreign stocks than domestic

-

The fund has had a decided tilt towards foreign stocks (33%) over domestic (27%). It comes from a desire to invest in industries that are not well represented in Canada (e.g. healthcare and technology) and because our managers have generally found cheaper stocks elsewhere.

- Within the foreign equity category, the bias has been away from the U.S. and towards Europe and Asia. This has been driven primarily by the manager of the Global Equity Fund, Edinburgh Partners Limited (EPL).

Impact – Bad short term. Good long term.

While this positioning was a godsend in 2015 when the Canadian stock market was down 8%, it proved to be a drag on the Founders Fund’s return in 2016. The resource sectors came to life last year and the S&P/TSX Composite Index had a 21% return, which made it the best performing market in the developed world.

Longer term, the bias towards non-Canadian stocks has been a meaningful positive.

3. Cash in lieu of bonds

-

We have long been of the view that near-zero interest rates are unsustainable. This has resulted in the fund consistently holding fewer bonds (22-25% of the fund) than the long-term target of 35%. In our view, low yields limit bonds’ upside potential and provide little protection against rising interest rates (when rates rise, bond prices fall).

- Nonetheless, bonds still provide useful diversification (high quality bonds do well in times of perceived crisis).

- In lieu of a full allocation to bonds, the fund has an unusually large cash reserve (17% at year-end).

- We should note that there was a brief period in the first half of 2016 when the cash reserve was used to buy stocks. It has since been replenished due to profit-taking (as noted above).

Impact – Negative with a ray of hope.

Over the history of the Founders Fund, bonds have generally beat cash, as interest rates have continued to plumb new lows. In addition, the Income Fund has done better that the overall bond market due to strategies deployed by the manager, Connor Clark & Lunn Investment Management (CC&L). This pattern changed in late October, however, when interest rates reversed course and moved meaningfully higher. Cash was king in the 4th quarter.

Positioning

Looking forward, the managers of the underlying funds are each pursuing strategies in their areas of expertise. They do all the heavy lifting when it comes to security selection and sector allocation, and it’s their strategies that largely shape the positioning of the Founders Fund.

Salman and I are charged with making sure the pieces fit together into a cohesive portfolio. We do our own work on corporate fundamentals (profit growth), valuations (price) and investor sentiment (market mood), which along with guidance from the managers, may cause us to adjust the allocations to the underlying funds from time to time.

Below is a summary of the most important strategies.

-

In the fixed income area, we’ve had a consistent bias towards corporate bonds, which is partly due to the design of the Income Fund and partly due to specific strategies by CC&L. That is still the case, although the positioning currently is as conservative as it’s been. The corporates we own are generally high quality (resulting in lower yields) and CC&L has chosen to own more Provincial Government bonds instead of corporate issues.

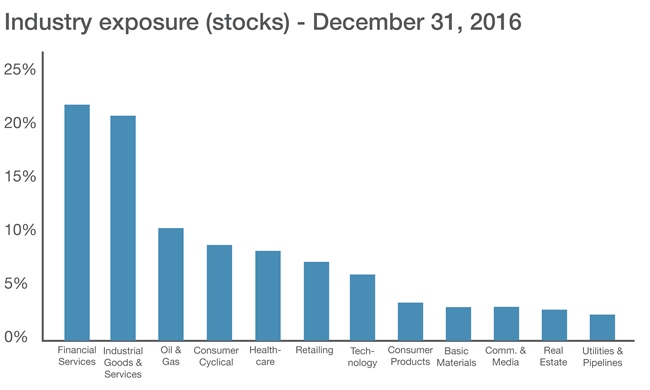

- On the equity side, the Founders Fund holds 121 stocks across a wide range of geographies, industries and company sizes. We will continue to favour foreign stocks over domestic.

- The fund’s Canadian exposure includes a mix of income-oriented securities (Income Fund), high-quality companies with growing dividends (Equity Fund), and smaller companies with higher growth potential (Small-Cap Equity Fund).

- On the foreign side, the Founders Fund is different than most balanced funds in that it has a relatively equal weighting between the U.S. (10.6%), Europe and the UK (12.7%) and Asia (9.2%). It has fewer U.S. stocks because the manager of the Global Equity Fund (EPL) sees more recovery potential and better valuations in the other regions.

- As the industry chart above indicates, the fund's holdings cover a broad range of industries. It’s hard to generalize, but the most noteworthy strategies would be an above-average exposure to pharmaceutical stocks and non-North American banks, and limited exposure to basic commodities and gold.

If you have questions or would like to talk about your portfolio, don’t hesitate to call us at 1-888-888-3147.

Management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The indicated rates of return are the historical annual total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns.