by Tom Bradley

When we’re going through times like this, I look for inspiration from people I trust, respect and know have been through it before. My favourite go-to person is Bob Hager, who was my friend, mentor and former business partner at PH&N. Bob passed away in 2011 but I know he would’ve found the virus crisis interesting. He was at his best when markets were at their worst.

We are following Bob’s playbook this time, as we did in the market pullbacks of 2008, 2011, 2016 and 2018.

“With every bear market, there are always unknowable concerns, and every time we’re told that this bear market is different.”

The impact of the coronavirus is like nothing we’ve seen before, both in human and economic terms. And it’s scarier than most crises because it’s hitting close to home and has the potential to profoundly change how we live in the years to come.

As we’ve talked about in previous updates, however, investing isn’t about positive news or perfect information. Rather, it’s about comparing the potential reward to the risk being taken, and assessing how much of the bad (or good) news is already factored into securities’ prices.

The declines in the stock market are unprecedented in their speed, although not in their depth. It’s our view that the stock prices have largely adjusted to (1) the economic valley we’re heading into, and (2) a less robust environment on the other side. We don’t know what either looks like, but like Bob, we’re pretty sure people are still going to need goods and services.

“My best trades turned out to be the ones when my hand was shaking as I gave Janice the blue ticket.”

Janice was our stock trader at PH&N and a blue ticket is a buy order.

Bob is referring to how hard it is to stick to your discipline when the news is bad and others around you are hiding under the table. But adhering to your process can prove very rewarding, especially when others are abandoning theirs.

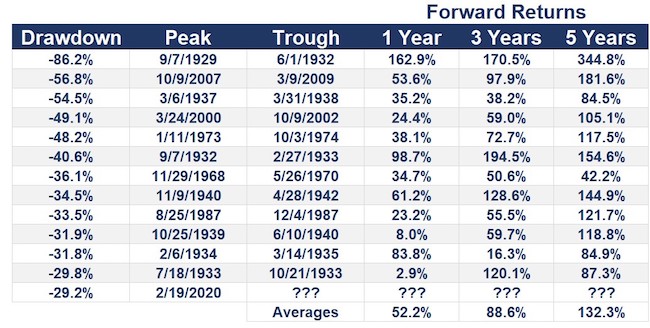

As the chart below demonstrates, there have always been strong recoveries after bear markets (the chart is courtesy of Ben Carlson’s A Wealth of Common Sense blog and refers to the U.S. market).

Keep in mind that hindsight is 20/20. In each case, we’re able to look back and identify the bottom or trough of the market. In real time, that’s not possible.

“Make sure you go up with more than you went down with.”

In the Founders Fund (and in the advice we provide clients), we’re living up to this edict. Going back up with less in stocks than you went down with is a formula for poor long-term returns.

We don’t know when the market will bottom, so we’re adding to stocks gradually, doing most of our buying on down days. We took our time getting started, but last Thursday, which was a particularly weak day, we began shifting money from the Savings Fund into the four equity funds held in the Founders. Unfortunately (or fortunately depending on your perspective), markets were even lower yesterday when we took another step in that direction.

“If you wait for certainty, you’ll miss the market.”

The Founders has a target stock allocation of 60%. A week ago, we were at 56% and today we’re at 63%. With the divergence in valuation between safe assets (expensive) and risky assets (cheap), our intention is to continue increasing the stock weighting. When and how quickly we move will depend on how things play out. (Note: Salman has provided some detail on how our fund managers are putting this money to work, and will keep doing so as things evolve.)

In this update, I’ve talked about the Founders Fund because it accounts for more than half of our clients’ assets (and is my favourite fund) but be assured, we bring the same disciplines to the Builders Fund. Salman generally keeps this fund fully invested which means there isn’t as much to do at times like this, but he’s using inflows to rebalance the fund holdings and keep them on target (35% Equity; 35% Global Equity; 15% Small-Cap Equity; and 15% Global Small-Cap Equity).

Bob rarely got it exactly right, and that was never his intention. We don’t expect to either. Rather, we think our clients will be well served if we get it approximately right by making hard (and lonely) decisions based on imperfect information and going back up with more stocks than we went down with.

We're not a bank.

Which means we don't have to communicate like one (phew!). Sign up for our blog to get the straight goods on investing.