by Salman Ahmed

All businesses are impacted by environmental, social and governance issues (ESG) in one way or another. However, the degree to which ESG issues influence a business can vary greatly. For example, a software company is more impacted by data privacy issues than a chemical company.

Focusing on topics with the most influence on a company’s performance is known as materiality. It’s a foundational concept of ‘ESG integration’ in our sustainability framework and distinguishes it from other streams of responsible investing including socially responsible investing (SRI).

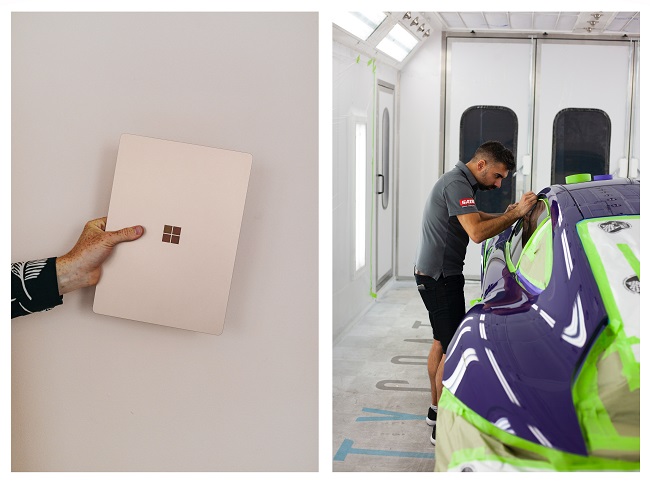

Portfolio managers use materiality to zero in on areas that require the most attention. Take Microsoft. It’s the largest holding in our Global Equity Fund and second largest in our Equity Fund. The company is a behemoth worth more than $3 trillion with products accessible across the globe. Its size and reach expose it to a myriad of ESG issues. When assessing Microsoft’s merits, our portfolio managers identify the ESG topics most likely to affect it. In practical terms that means more time reviewing data security and competitive behaviour and little time on waste disposal practices.

The opposite is true for Axalta, another holding in our Global Equity Fund. The company produces industrial coatings like car paints. Its waste disposal practices will have a material impact on the company and require careful consideration – far more than its data privacy practices.

Managers can go about researching the degree of impact once the key ESG topics for a company have been identified. With Microsoft, that might mean reviewing the company’s policies, how it responded to past data privacy scares and getting the opinion of data experts.

It’s important to note that our managers aren’t expecting an absence of ESG risks. Microsoft will be exposed to privacy risks as long as it sells software. This is the key distinction between ESG integration (our approach) and SRI. Managers using the SRI approach try to eliminate certain ESG risks altogether. Under the integration approach, managers weigh a company’s potential with the probability of ESG issues materially influencing its performance. It’s our conclusion that the latter is more suited to deal with the plethora of ESG issues society faces while also allowing for superior investment returns.

We're not a bank.

Which means we don't have to communicate like one (phew!). Sign up for our blog to get the straight goods on investing.