by Scott Ronalds

I was going through an old marketing file and found a gem that never saw the light of day. It came courtesy of a firm we worked with several years ago when we were doing some thinking around our messaging and value proposition.

The piece was designed to resonate with Canadians who are nearing retirement. Specifically, those who are a little uncertain about their investment choices and whether they’ll be able to live the life they want after they stop working.

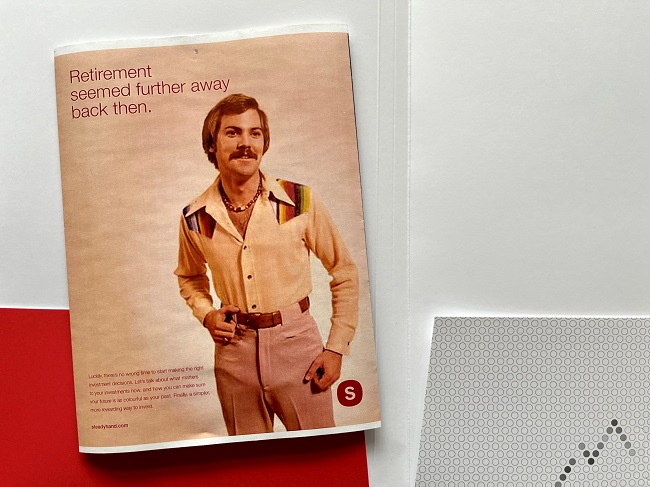

The imagery was dynamite, in my humble opinion. It’s got a “Three’s Company” and Jack Tripper vibe, circa 1980. And who doesn’t love a good leisure suit? The copy read:

Retirement seemed further away back then. Luckily, there’s no wrong time to start making the right investment decisions. Let’s talk about what matters to your investments now, and how you can make sure your future is as colourful as your past.

After speaking with thousands of investors over the years, we know there are a lot of Canadians who share the above concerns.

Some common questions reverberate in our conversations.

-

Will I have enough?

- Should I be changing my asset mix and investments?

- What’s the best way to start drawing on my portfolio?

- What’s the process of converting my RSP?

- How should I view my pension in relation to my overall portfolio?

If you’ve got a sequined jumpsuit and platform heels gathering dust in the closet, you may be asking these same questions. We want to let you know we’re here to answer them. With no judgement (wardrobe included).

Investment advice is an important part of our offering. This includes guidance on retirement thinking and preparation. And if your situation requires in-depth modeling, we have a network of fee-for-service specialists we can refer you to.

Retirement may have seemed further away back then, but there’s no reason the last third of your life can’t be as vibrant as the first third with the proper investment footing.

Book a meeting with one of our Investor Specialists to discuss your situation.

P.S. If you’re wondering why we never ran the piece, it’s because we don’t spend a lot on advertising, which is part of how we keep our fees low. But with moustaches making a comeback, maybe we need to strike while the iron’s hot.

We're not a bank.

Which means we don't have to communicate like one (phew!). Sign up for our Newsletter and Blog and join the thousands of other Canadians who appreciate the straight goods on investing.