by Tom Bradley

2024 was a great time to be an investor while at the same time being one of the most confusing and noisy years I can remember. If you’re like me, you may be looking for a retreat from the holiday mayhem, AI mania, Ottawa and Washington upheaval, and Taylor Swift hangover.

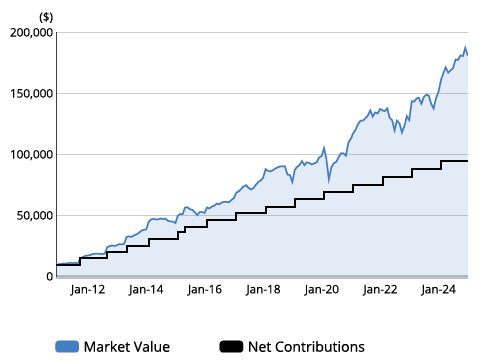

I have a suggestion. Open your client statement and go to the picture in the bottom right corner of page 3. You know it. It’s a simple chart with two lines. The black one indicates the net amount you’ve invested in your Steadyhand accounts and the blue one (with the shaded area underneath it) is the market value. The difference between the two is what your money has earned.

Sample Client Statement Performance Chart

It’s a picture worth at least a thousand words, including these calming takeaways.

The 8th wonder of the world – That’s what Albert Einstein called the power of compound interest. If you’ve been with us a while, the picture illustrates his point. Sticking to a plan and giving it time to play out is indeed powerful. As the adage goes, ‘investing is about time in the market, not market timing.’

Nonlinear – The blue line trends toward the top right corner of the chart but there are lots of zigs and zags along the way. I’ve heard Lori Norman, one of our Investor Specialists, describe it to clients as “nonlinear”. That’s for sure. It’s not a smooth path and you shouldn’t expect it to be.

Foggy memories – The chart serves to cloud your memory of what previously happened in your portfolio. In a good way. The reasons for the dips, that seemed so important and defining at the time, are now just vague memories, or completely forgotten. Was it that banking crisis thing in the U.S., the shooting down of a Chinese balloon, or was it something said at the economists’ confab in Jackson Hole. Whatever it was, it appears to have been inconsequential.

Benefits of steady – Rudyard Kipling had it right when he said, “If you can keep your head when all about you are losing theirs …” (from If: A Father’s Advice to His Son). In a gunfight or hockey game, great instincts and quick reactions are invaluable (and perhaps lifesaving), but in investing, rewards come from doing exactly the opposite, keeping your head and staying steady.

I hope you can go forth in 2025 with a renewed sense of calm. And if you feel it slipping away, pull up your latest statement on steadyhand.com, or call 1-888-888-3147 for a calming voice.

I encourage you to read the rest of our Q4 Report, where we provide more details on our specific strategies and what we've been doing in each of our funds.

We're not a bank.

Which means we don't have to communicate like one (phew!). Sign up for our Newsletter and Blog and join the thousands of other Canadians who appreciate the straight goods on investing.