By Scott Ronalds

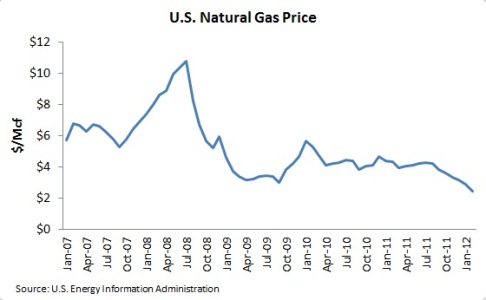

We’re in one of the greatest bear markets of all time. In natural gas, that is. The commodity’s price has fallen from over $10 per thousand cubic feet (Mcf) in July 2008 to about $2.50 today. Last month, it touched $1.90, representing a decline of roughly 85% from peak to trough.

Natural gas is used to heat and cool homes and generate electricity. It is also used in the production of plastics, fabrics and fertilizers, and among other applications, can be used to run vehicles (although until recently it has been more expensive than gasoline). Further, it’s a cleaner fuel than coal, which is more commonly used in generating electricity.

Over the past few years, advancements in drilling techniques – notably hydraulic fracturing (“fracking”) and horizontal drilling – and new discoveries in shale rock formations in areas such as Louisiana, Arkansas, Texas and Pennsylvania, have led to a massive increase in supply. Promising fields are also being developed in B.C., Alberta, Quebec and New Brunswick. Estimates suggest the new fields south of the border could provide enough gas to satisfy U.S. demand for decades. And to think that in the mid 2000’s many experts thought production was in permanent decline.

Add a warm winter to the equation (roughly half of American homes are heated by natural gas), and the continent is currently swimming in the commodity. In fact, there are concerns that storage facilities will soon be full and producers will have to turn off the taps or dump gas.

It seems a shame. Natural gas is a cleaner alternative than many fossil fuels, yet it’s not being used in enough industries to soak up the massive inventories. The commodity sells for much more in Europe and Asia ($8 - $16/Mcf), but it’s not cheap or easy to transport overseas. Advocates of the fuel also see it as a way to fight climate change and reduce dependence on foreign oil.

Why aren’t more industries and businesses using natural gas? For one, it’s expensive to modify machinery, vehicles and service stations. Also, businesses can be tied into long-term contracts for coal or other fuels. And finally, there’s no guarantee it will remain a cheaper alternative to coal and gasoline.

There are radically different views on natural gas in the investment community. Some analysts believe that prices are bound to stay depressed, if not fall much further, because supply will continue to outstrip demand. Others feel that the spread between natural gas and oil prices is unsustainable (oil is currently about 40x more expensive; the historic norm is around 10x) and the commodity is sure to rebound as more industries make the change, more governments implement green incentives, and new facilities and technologies make it easier to export.

As a Steadyhand investor, you want to know what our managers think of natural gas and the role it plays in your portfolio. We break it down by fund below.

Income Fund

With respect to the fund’s income-equities, the manager’s focus (Connor, Clark & Lunn) is on companies that generate steady cash flows and have the financial strength to pay rising dividends. Because of the volatile nature of natural gas prices, direct producers typically don’t fit CC&L’s investment criteria. Natural gas producers do not generate stable income and the manager is not comfortable with the dividend sustainability of many of these businesses. Accordingly, they do not own any direct producers in the fund.

The portfolio does have limited exposure to the commodity through oil & gas service providers such as Enbridge and Gibson Energy. These are midstream businesses, meaning they are involved primarily in storing and transporting energy. Both companies, however, are more focused on oil than natural gas.

Equity Fund

CGOV Asset Management, the manager of the fund, feels that it’s anyone’s guess as to what will happen to natural gas prices in the short term. Gord O’Reilly (the lead manager) believes the magnitude of the price decline has been so great, however, that a reversion to the mean is likely over time, particularly as liquefied natural gas (LNG) export facilities come into production over the next few years (facilities have been approved in Louisiana and Kitimat) and more electric utilities and commercial vehicles convert to natural gas.

Yet, producers aren’t making profits at current prices and Gord feels it’s difficult to find value in the sector beyond CGOV’s two holdings, Birchcliff Energy and Pason Systems. Birchcliff is focused on natural gas exploration and production in Alberta (with some light oil production as well). The manager likes Birchcliff because it has valuable land assets and the ability to rapidly increase reserves. Their light oil production also helps pay the bills. The stock has been the subject of acquisition talk and has bounced around as a result. Pason provides rental oilfield instrumentation systems for oil & gas drilling and service rigs. Although low prices have hurt gas drilling, strong oil drilling activity has helped compensate.

Global Equity Fund

The natural gas landscape outside of North America is much different. The demand/supply equation is more balanced. The closure of nuclear power plants in Japan and Germany has added to demand, while a new wave of LNG coming out of the Asia-Pacific region and the Middle East has contributed to supply. Shale-related supplies are not as plentiful, however, due to inferior geology. Natural gas prices range from the equivalent of $11/Mcf in northwest Europe, to $13 in the Middle East and close to $16 in Japan. The manager of the fund, Edinburgh Partners Limited, believes that gas will play a greater role in the world’s longer-term energy mix, with demand growth concentrated in power generation and the ever-increasing global vehicle fleet.

The fund holds three investments with meaningful exposure to natural gas. Russian-based Gazprom holds the world’s largest natural gas reserves and owns the world’s largest gas transmission network. The company accounts for 15% of global gas output, supplies roughly 25% of Europe’s gas requirements and exports gas to more than 30 countries. ENI is an Italian-based energy conglomerate with a significant natural gas division that produces and sells the fuel throughout Europe and abroad. Petrobras is a Brazilian oil and gas producer and the 5th largest energy company in the world. Although its focus is more on oil, gas is an important division.

Small-Cap Equity Fund

While there are plenty of small-cap resource companies operating in western Canada, few natural gas-focused businesses represent attractive investment opportunities in the manager’s view (Wil Wutherich). Wil feels that stock valuations are expensive at current gas prices. Unless the price of the commodity rises to around $5/Mcf in the near term (Wutherich is skeptical of this happening), he believes that most companies will be hard-pressed to produce compelling profits.

Currently, the fund does not hold any pure natural gas producers. It does, however, own some companies with business divisions that are focused in part on natural gas. Of note, Total Energy Services provides drilling rigs and gas compression equipment to western Canadian producers. As well, Badger Daylighting provides excavation services that are used in the energy field for tank and pipeline cleaning, pipeline trenching, and repair and construction activities. Wutherich has a handful of other gas-related businesses that he knows well and watches closely, but feels they aren’t attractive investments at current prices.

Summary

If you hold a balanced portfolio of our funds (or the Founders Fund), you have modest exposure to natural gas. Our managers’ focus in North America is primarily on natural gas service providers that also serve the oil industry and therefore have a more diverse revenue base. CC&L, CGOV, and Wutherich & Co. are more cautious of direct producers (Birchcliff Energy provides the greatest direct exposure). The landscape is quite different outside North America, where natural gas prices can be 4-6X higher. The Global Equity Fund has holdings in Russia (Gazprom), Italy (ENI) and Brazil (Petrobras), providing you with diversified exposure to a number of international gas markets.