By Tom Bradley

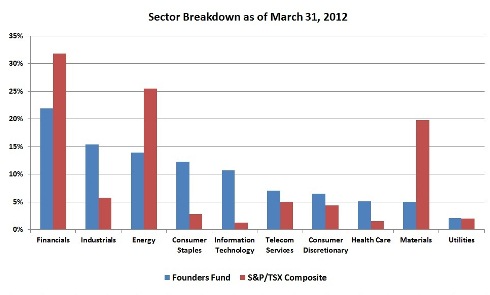

In recent presentations, we’ve been discussing a slide that shows the industry diversification of the Founders Fund versus the S&P/TSX Composite Index. We’ve been doing this admittedly ‘apples to oranges’ comparison because it highlights what the portfolios of many Canadians look like (heavy home country bias, lots of financials and resources) compared to our new fund, which has a more balanced representation from around the world.

What jumps out when looking at the bar chart is the three big spikes for the TSX, namely financials, energy and materials. Conversely, there is little exposure to some significant parts of the economy – industrials, consumer, technology and healthcare.

The stocks in the Founders Fund are more evenly balanced across industries. The financials make up the largest weighting (banks and insurers are a large part of the underlying Income Fund), but beyond that, the differences between the fund and index are stark. The industrial and consumer sectors are meaningful weightings, as is technology.

Investors with a focus on Canada (particularly index-oriented investors) are heavily tilted towards two homogeneous sectors of the economy. The Founders Fund, which currently holds more foreign stocks than Canadian, is diversified across a wider array of economic factors.