By Scott Ronalds

We’ve had a cautious view on government bonds for several quarters, as yields are unsustainably low. Our current thinking hasn’t changed. We feel bonds are expensive and have been advising clients to keep them to a minimum in relation to their long-term asset mix.

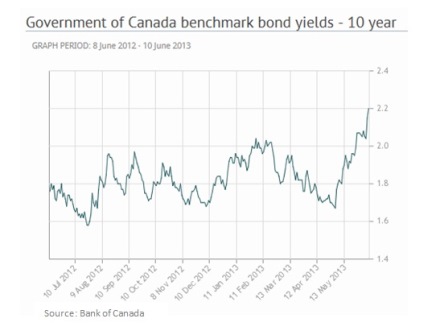

The yield on 10-year Government of Canada bonds has risen over the last six weeks, from under 1.7% in early May to 2.2% yesterday. This is a sharp move in a low interest rate environment and explains why the Canadian bond market is on track for a weak quarter.

It’s anyone’s guess as to which direction bond yields will move over the next day, week or month. We feel that interest rates are likely to rise over the next few years, however, which is why we’ve been advising caution and projecting lower return expectations for this asset class (when interest rates and yields rise, bond prices fall).

Our focus in this area is on corporate bonds, which are typically less sensitive to movements in interest rates and have higher coupon payments. Our Income Fund also has a shorter than normal average term-to-maturity as a defensive measure against rising interest rates.