By Scott Ronalds

If you haven’t rebalanced your portfolio in a while, it’s probably time. Especially if your strategic asset mix (SAM) is tilted towards equities. Stocks have gone up a lot over the last few years, and you shouldn’t have more risk in your portfolio than your plan calls for.

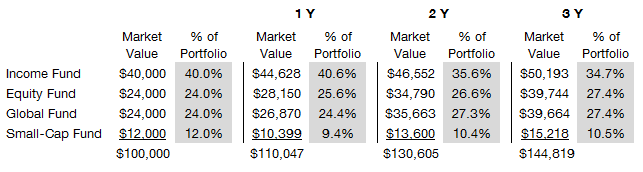

Consider an investment of $100,000 in our hypothetical Balanced Equity Portfolio. The portfolio is comprised of four funds (see allocations below) and has an asset mix of 70% stocks, 30% bonds.

Let’s look at the portfolio’s growth and composition over a few different time periods (all ending February 28th), assuming no rebalancing was done.

Investors who have held the portfolio for only a year should consider topping up the Small-Cap Fund by trimming the Equity Fund.

For investors who have held the portfolio for two years and haven’t made any adjustments, more action is recommended. The weight of the Income Fund in the portfolio has drifted almost 5% lower (from 40% to 35.6%), which is often a good trigger for rebalancing. The drift isn’t because the Income Fund has performed poorly, but rather that the Equity Fund and Global Fund have produced particularly strong returns over the 2-year period.

A wise course of action would be to rebalance the fund weightings back to the target allocation. An effective way of doing this would be to allocate any near-term contributions to the Income and Small-Cap funds. Or, the portfolio could be rebalanced by trimming both the Equity Fund and Global Fund to bring their weightings back to the target allocation, and allocating the proceeds to the Income Fund and Small-Cap Fund. In our example, this would mean selling roughly $3,400 of the Equity Fund and $4,300 of the Global Fund, and buying $5,700 of the Income Fund and $2,000 of the Small-Cap Fund.

A similar exercise would be prudent for investors who have held the portfolio for three years or longer.

Establishing a rebalancing discipline is important because it keeps your asset mix on track and helps take emotion out of the investment process. We recommend you look at rebalancing your portfolio either (1) annually, at a pre-determined date (e.g. January), or (2) when your asset class or fund weightings drift 5% from your targets (e.g. your stock weighting rises from 60% to 65%).

Management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The indicated rates of return are the historical annual total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns.