by Scott Ronalds

In his latest Financial Post article, Tom Bradley (Steadyhand Chair and Co-founder) highlighted Nvidia as a company that is constantly in the headlines and has become the poster child for a trend that’s changing the economy — artificial intelligence (AI).

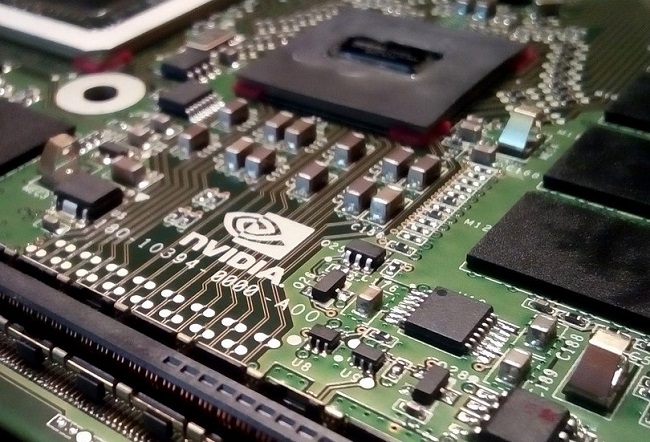

Nvidia is the dominant designer of leading-edge semiconductors that power machine learning and AI models. The stock has more than tripled in price this year and is now the fifth most valuable company in the world. As Tom mentions in his article, fund managers who own it have a great story to tell and those who don’t have had trouble keeping up with the market and may be fielding some questions from clients.

We fall into the latter camp; we don’t own the stock in any of our funds. While Nvidia is a great company, it has always seemed too expensive in our fund managers’ eyes. Whether based on price-to-earnings, book value, sales, or other measures, its valuation has continually exceeded our comfort level. Admittedly, we’ve been wrong (judging by the stock’s massive rise).

As we look forward, though, our managers believe the stock is not compelling from an upside/downside perspective for reasons that have to do with many of the uncertainties Tom identifies in his piece. Let me elaborate.

First, the stock’s valuation remains very high, implying that everything will continue to go Nvidia’s way. As the tech industry has taught us repeatedly, this is rarely the case.

Further, while demand for Nvidia’s products seems endless right now, the semiconductor industry is still cyclical and it’s not a given that tech companies will be buying chips at today’s pace. Moreover, there are deep-pocketed competitors that want some of the market share.

Then there’s the geopolitical angle. Nvidia relies solely on Taiwan Semiconductor Manufacturing Company (TSMC) to manufacture its advanced AI chips. Tensions between China and Taiwan have been escalating, and any invasion or attempted expropriation of facilities would create havoc for the company and industry (the manufacturing process cannot be easily switched to another plant or country, as the factories take years to build and cost billions of dollars).

There are other reasons for caution, but perhaps the lead manager of our Equity Fund, Gord O’Reilly, best sums up why we don’t own the stock today: “Nvidia carries a whole bunch of risks that we simply choose not to take on.”

We're not a bank.

Which means we don't have to communicate like one (phew!). Sign up for our Newsletter and Blog and join the thousands of other Canadians who appreciate the straight goods on investing.