by Scott Ronalds

China’s real estate and finance sectors are under stress. Exports are falling. Relations with the West are on poor terms. Youth unemployment levels are troubling. And the U.S. is trying to hamper the country’s technological progress by cutting it off from leading-edge semiconductors. Confidence in the country’s stock market, in turn, is eroding.

Witness the numbers: the Chinese market is down 5% this year (Morningstar China All Cap Index) while global stocks (Morningstar Developed Markets Index) are up 15% (as of August 31).

It has some of our clients asking how much exposure they have to China.

The short answer: our exposure is modest. We do not hold any Chinese stocks in our funds. The country’s lack of transparency, governance issues, and the heavy hand of its government make it a challenging place in which to invest directly. That said, China’s enormous economy and rapidly growing middle class cannot be ignored. We gain our exposure indirectly through foreign companies that sell goods and services to Chinese consumers and businesses.

Our focus is mainly on multinational corporations that have exposure to the Chinese consumer but are not overly reliant on sales in the region to sustain their growth and profitability. Examples include Coca-Cola, Sony, Procter & Gamble, Samsung Electronics, Danaher, and Michelin. We also own businesses with no revenue ties to China, such as Telus, Metro, Aritzia, and Casella Waste Systems.

In addition, however, our funds own a small group of companies that generate a sizeable portion of their revenues in the country. AIA Group (Hong Kong-based insurance company), for example, derives roughly three-quarters of its revenues from the mainland, and Qualcomm (American designer of chips for smartphones) generates nearly two-thirds of its sales there. Chinese tourists also represent an important source of revenue for French luxury giant LVMH (Louis Vuitton Moet Hennessy) and Japanese retailer Pan Pacific International Holdings.

And it’s hard to avoid companies that are important customers of China’s vast manufacturing complex, although this dynamic is slowly changing. Businesses are diversifying their supply chains to other Asian countries and nearshoring (bringing manufacturing back home).

When evaluating a company, one of the things our managers consider is its supply chain and related risks. Businesses that are wholly reliant on Chinese manufacturing (or any one emerging market country for that matter) are deemed unattractive.

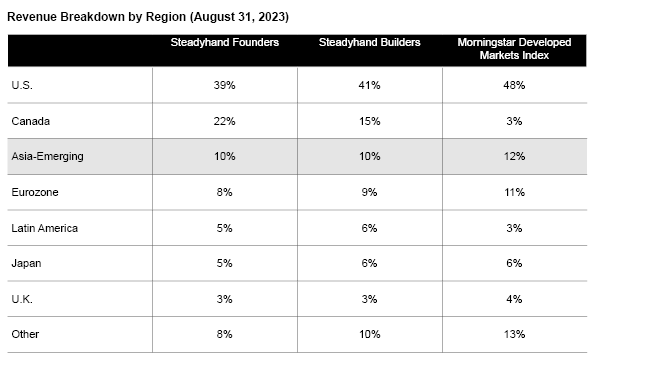

When we break out our funds' overall revenue exposure by region (e.g., where the companies we own generate their sales), the Founders Fund has 10% of its equity holdings’ revenues coming from “Asia-Emerging”, which includes China as well as other emerging markets in the area. For perspective, the Founders Fund’s biggest area of revenue exposure is the U.S., at 39%, followed by Canada (22%). The Eurozone (8%), Latin America (5%), Japan (5%), and the U.K. (3%) make up the rest. The Builders Fund’s component companies generate similar amounts of revenues from these regions (calculations are done by Morningstar Direct, an investment research service).

While China is currently in the hot seat and has some governance and credibility challenges to overcome, it still holds intrigue and opportunity from a long-term investment perspective. We believe our exposure is well measured in this regard.

We're not a bank.

Which means we don't have to communicate like one (phew!). Sign up for our Newsletter and Blog and join the thousands of other Canadians who appreciate the straight goods on investing.