By Tom Bradley

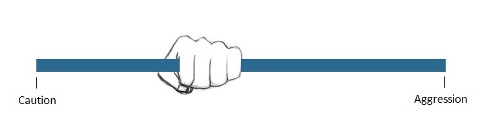

The Grip (see above), which is our tool for expressing our overall portfolio strategy, was a new feature in the June Quarterly Report, but the cautious stance it signaled was not. Since January, we’ve recommended that clients be positioned conservatively and where appropriate, set aside some cash. We’ve been worried about the challenges of a debt-laden economy and the fact that interest rates are likely to trend up over the next few years.

So how are we sitting today? Well, pretty awkwardly I must say. Not because the markets have got us spooked (although it’s been no fun lately), but because we don’t think of ourselves as market timers. And yet, anything we say at this juncture will have a heaping portion of market timing.

In any case, here is what I think is happening and what we’d recommend doing about it.

Current Situation

- We’re going through a particularly bad patch of news right now, but for the most part it’s just another chapter of the same story. The western world has been living beyond its means (way beyond) and now finds itself deep in debt. As a result, this economic cycle will be bumpier and less robust than normal. In my view, we will muddle through the challenges, with growth being driven increasingly by the emerging economies in Asia and South America. The growth will come with lots of drama, however, so we might as well get used to it.

- The flight to safety in recent weeks has pushed up the ‘safe’ currencies (Swiss Franc, Yen) and pushed down bond yields (10-year government bonds in Canada and the U.S. are now at 2.5%). It has been my feeling for a while that yields are artificially low, so to me this current decline looks like a temporary reaction to the recent bout of uncertainty.

- It’s likely that corporations will find it tougher to grow in the next year or two, but Corporate America (and Canada and International) is well capitalized. An accommodating corporate bond market and strong stock markets have allowed companies to build up their balance sheets.

Going Forward

As our name connotes and my investing personality suggests, we’re measured in our actions, particularly at times of crisis or euphoria. Whatever we do, we make decisions in the context of our clients’ long-term plans, specifically their strategic asset mix (SAM). For Steadyhand clients, it’s important to remember that most of the heavy lifting is being done by the fund managers. They’re reacting to emerging risks/opportunities and making changes when appropriate. But at the portfolio level, there may be some adjustments needed too.

- Cash – We’ve had a few calls from clients asking whether they should hunker down further. Is it time to sell stocks and get into cash? While every situation is different (we encourage you to call us if you want to discuss your portfolio), we’re not generally recommending that. We don’t want to sell beaten-up stocks to increase the cash reserve. As for the existing cash, we’d keep it in place for now.

- Bonds – We’ve been recommending going light on bonds. While we’ve been early on that call, we feel even more strongly now that valuations on bonds are extreme (expensive). So we strongly recommend that clients hold a less-than-full allocation of bonds. If some selling is required, the recent run-up in prices is a good opportunity. Whether the money goes into cash or stocks will depend on the particular situation.

- Stocks – For clients who’ve been following our guidance and have a stock allocation in line with, or slightly less than, your SAM, there isn’t much to do just yet. We’d like to see the current crisis play out a little further. Those who don’t have a full allocation should use this weakness to do some buying. Most or all of the bad news has been absorbed into the prices and valuations have improved.

The recent market action has been disarming, but I don’t believe we’re in a situation like 1999 or 2007. The stock market is well grounded in the realities of the day (debt, slow growth, power shifting to emerging economies) and isn’t trading at extremes valuations. Indeed, some sectors may be moving into ‘cheap’ territory.

The Grip is still indicating caution, but it’s time to start thinking about what to buy.

Note: For readers who are substantially out of the stock market, we want to be very clear - Now is the time to take your first step at getting back. You have a long way to go to being fully invested and this is what you’ve been waiting for. GET STARTED!