Cutting Through the Noise

September 21, 2011

I was talking with a client last week about portfolio re-balancing and the challenges of volatile markets. I often tell the story of Bob Hager’s shaking hand to illustrate how hard it is to do the right thing when markets are down, but his story is just as good at bringing the...

Read MoreSeptember 19, 2011

The passive (indexing) vs. active management question is a polarizing debate, but it shouldn’t be. The bottom line is that both strategies have merit when they’re done right. As Morningstar USA’s President of Fund Research (Don Phillips) notes, credible...

Read MoreSeptember 17, 2011

“Isn’t it funny when you walk into an investment firm and see the financial advisers watching CNBC. It gives me the same feeling of confidence I would have if I walked into the Mayo Clinic and the doctors were watching General Hospital.” This little...

Read MoreSeptember 15, 2011

Wil Wutherich, the manager of our Small-Cap Equity Fund, is in town this week on a research trip. We booked an afternoon of his time to discuss the fund. Since we've covered his investment process in previous sessions and his philosophy is well documented on our site, Tom sat down with him to talk stocks...

Read MoreSeptember 13, 2011

‘skin in the game’ … ‘eating our own cooking’ … ‘co-investment’ … ‘manager-client alignment’ … These are all phrases we use to describe our commitment to clients and the desire to have our interests closely aligned to theirs. This alignment takes many...

Read MoreSeptember 12, 2011

As a kid, my family and I used to go on a summer holiday every year to Savary Island (a small island about 200 km north of Vancouver). It’s a bit of a hidden treasure, with white sand beaches, warm waters and an abundance of shellfish. There was no electricity, few cars and fewer rules (don’t bury your sister and be home for dinner). We loved it. I was back on the Island this summer and few things have...

Read MoreSeptember 9, 2011

"The stock market has forecast nine of the last five recessions" - Paul Samuelson (Nobel Economist)

Read MoreSeptember 7, 2011

We often remind our clients that they don’t need to do much once their portfolios are set up, as our managers do most of the heavy lifting. While it may sound like lip service, it’s a phrase that carries weight. In times of heightened volatility, such as the past two...

Read MoreSeptember 3, 2011

I got turned on to finance while stumbling through my MBA at the University of Western Ontario. I suddenly found myself reading Report on Business right after the Sports section (go figure). When it came to finding a job, I got lucky. There weren't many...

Read MoreSeptember 1, 2011

Last month we introduced Bruce, a forty-something investor with a balanced portfolio (tilted towards equities). Bruce spent the last three weeks of August on vacation and tuned out the noise in the markets as best he could. The single malt helped. While catching up on his reading this week, however, he came across two pieces by Tom which encouraged him to make an adjustment to his portfolio (What Now? Part II and When Fear Rules the Market, it's Time to...

Read MoreAugust 26, 2011

It was announced this week that Vanguard will start in Canada with 6 ETFs. In response to the news, blogger Michael James expressed disappointment that the 2 foreign equity funds would be hedged back into Canadian dollars. I wholeheartedly agree with his view.

Read MoreAugust 25, 2011

Tom was on BNN this morning discussing how we think about asset allocation and portfolio positioning in volatile markets. It’s all about being ‘approximately right’ rather than exactly wrong. In other words, you’re never going to pick the top or bottom of...

Read MoreAugust 24, 2011

Nalco, the world’s leading water treatment company, recently entered into a merger agreement with Ecolab (a provider of cleaning, food safety and infection prevention products and services). CGOV, the manager of our Equity Fund, sold the stock...

Read MoreAugust 21, 2011

In light of the recent weakness and volatility in the stock market, both statements are particularly poignant. It’s easy to agree with the logic and simplicity of Warren Buffett, but not so easy to behave like him. My former partner's shaking hand reinforces...

Read MoreAugust 16, 2011

One of the richest men in the world wishes he was taxed more. Warren Buffett paid $7 million in federal taxes last year, which equated to 17% of his taxable income. Surprisingly, this was the lowest rate of any of the 20 employees in his office. In a...

Read MoreAugust 15, 2011

I came across a commentary in the Financial Times this week on the downgrade of U.S. government debt by the rating agency Standard and Poor’s. I highlight it because there’s a hate-on for the U.S. and we know all its warts. In arguing that S&P got it wrong...

Read MoreAugust 10, 2011

What are the stock market declines telling us (other than we’re temporarily poorer)? Are they signaling the end of the world as we know it or, as a veteran value manager suggested to me yesterday, are we entering “opportunity-laden times?” In my view...

Read MoreAugust 6, 2011

“Hey Tom, how was your holiday? The weather’s been great – skiing conditions must have been calm?” “Oh Ralphie, it was amazing. Two weeks of Crystal Lake at its best. I’m totally decompressed. But what about you man? You’re looking pretty ragged...

Read MoreAugust 5, 2011

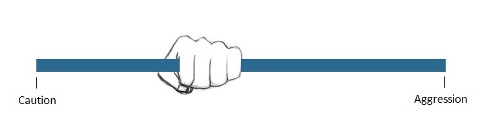

The Grip, which is our tool for expressing our overall portfolio strategy, was a new feature in the June Quarterly Report, but the cautious stance it signaled was not. Since January, we’ve recommended that clients be positioned conservatively and where...

Read MoreAugust 4, 2011

Meet Bruce. He shares several traits of investors who we deal with every day. In many ways, he is representative of a typical Steadyhand client. In this blog series, we’ll follow his investing journey and provide periodic updates on the decisions and challenges he faces. Bruce is a married forty-something software engineer with two pre-teen kids. His wife, Courtney, works part-time in marketing and the couple makes a combined annual income of approx. $180,000. They own a house in North Vancouver worth roughly $750,000 ...

Read MoreJuly 27, 2011

I was reviewing a new client’s portfolio last week and I stumbled across the Manulife Simplicity Balanced Portfolio. It’s a fund-of-funds product, meaning it holds a basket of mutual funds. In this case, the Portfolio holds 18 funds (as of December 31, 2010)...

Read MoreJuly 23, 2011

I recently spoke at a conference about the future of the wealth management industry. It was a good audience, but a bad gig. No matter what I said, I was sure to be wrong about some things. As Yogi Berra said, "It1s tough to make predictions, especially...

Read MoreJuly 20, 2011

At Steadyhand, we think we’ve got the best business model and investment philosophy around. We offer investors access to talented and experienced investment managers (who are typically only available to the ultra-wealthy) and straight advice. We invest alongside our clients, charge low fees and provide timely &...

Read MoreJuly 18, 2011

My last Globe column (Of Cash and Quality Stocks) prompted a reader to ask, “Do you believe Canadian Banks will be able to grow their dividends at a healthy clip going forward? Is the growth of the Canadian Banks over?” In the past, I've underestimated...

Read MoreJuly 14, 2011

In a post last week, Larry Swedroe wrote about one of our favourite topics – the behavioral gap. I’m referring of course to investor behavior, not child rearing or post-Stanley Cup rioting. In an investment context, the term refers to the gap in returns between mutual funds and the investors that buy them. In study after study...

Read More