Cutting Through the Noise

September 17, 2011

“Isn’t it funny when you walk into an investment firm and see the financial advisers watching CNBC. It gives me the same feeling of confidence I would have if I walked into the Mayo Clinic and the doctors were watching General Hospital.” This little...

Read MoreSeptember 13, 2011

‘skin in the game’ … ‘eating our own cooking’ … ‘co-investment’ … ‘manager-client alignment’ … These are all phrases we use to describe our commitment to clients and the desire to have our interests closely aligned to theirs. This alignment takes many...

Read MoreSeptember 3, 2011

I got turned on to finance while stumbling through my MBA at the University of Western Ontario. I suddenly found myself reading Report on Business right after the Sports section (go figure). When it came to finding a job, I got lucky. There weren't many...

Read MoreAugust 26, 2011

It was announced this week that Vanguard will start in Canada with 6 ETFs. In response to the news, blogger Michael James expressed disappointment that the 2 foreign equity funds would be hedged back into Canadian dollars. I wholeheartedly agree with his view.

Read MoreAugust 21, 2011

In light of the recent weakness and volatility in the stock market, both statements are particularly poignant. It’s easy to agree with the logic and simplicity of Warren Buffett, but not so easy to behave like him. My former partner's shaking hand reinforces...

Read MoreAugust 15, 2011

I came across a commentary in the Financial Times this week on the downgrade of U.S. government debt by the rating agency Standard and Poor’s. I highlight it because there’s a hate-on for the U.S. and we know all its warts. In arguing that S&P got it wrong...

Read MoreAugust 10, 2011

What are the stock market declines telling us (other than we’re temporarily poorer)? Are they signaling the end of the world as we know it or, as a veteran value manager suggested to me yesterday, are we entering “opportunity-laden times?” In my view...

Read MoreAugust 6, 2011

“Hey Tom, how was your holiday? The weather’s been great – skiing conditions must have been calm?” “Oh Ralphie, it was amazing. Two weeks of Crystal Lake at its best. I’m totally decompressed. But what about you man? You’re looking pretty ragged...

Read MoreAugust 5, 2011

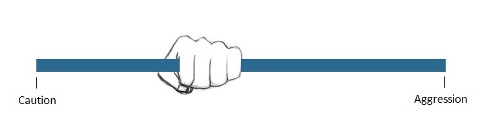

The Grip, which is our tool for expressing our overall portfolio strategy, was a new feature in the June Quarterly Report, but the cautious stance it signaled was not. Since January, we’ve recommended that clients be positioned conservatively and where...

Read MoreJuly 23, 2011

I recently spoke at a conference about the future of the wealth management industry. It was a good audience, but a bad gig. No matter what I said, I was sure to be wrong about some things. As Yogi Berra said, "It1s tough to make predictions, especially...

Read MoreJuly 18, 2011

My last Globe column (Of Cash and Quality Stocks) prompted a reader to ask, “Do you believe Canadian Banks will be able to grow their dividends at a healthy clip going forward? Is the growth of the Canadian Banks over?” In the past, I've underestimated...

Read MoreJuly 14, 2011

In a post last week, Larry Swedroe wrote about one of our favourite topics – the behavioral gap. I’m referring of course to investor behavior, not child rearing or post-Stanley Cup rioting. In an investment context, the term refers to the gap in returns between mutual funds and the investors that buy them. In study after study...

Read MoreJuly 8, 2011

Are you confused? I certainly am. It’s not clear whether investors are on a risk-taking binge, or are battening down the hatches for another market decline. There is plenty of evidence in support of the risk binge. Technology IPOs are coming out at exotic...

Read MoreJune 28, 2011

Canadian Couch Potato posted an interesting blog yesterday. Dan Bortolotti, the author of this highly-rated blog (in a recent Globe and Mail contest, it was voted the best investing blog in Canada), thinks we need to stop fighting about which is better...

Read MoreJune 24, 2011

We’ve had low interest rates for years, and really low rates for almost three. We’re used to them, and may even be getting complacent. I had more questions and concerns from clients about rising interest rates a year or two ago than I do now. Well, I’m here to...

Read MoreJune 20, 2011

In his June 6th letter, Tim Price of PFP Wealth Management in the UK provides a thoughtful take on our debt burden. “From a narrowly financial perspective, government debt is an asset class, albeit an asset class now offering vast potential for capital...

Read MoreJune 14, 2011

When I was an analyst on the brokerage side of the business (1980’s ... I was a teenager), there were a few iconic people that we all looked up to. Hugh Brown, who was with Burns Fry (now part of BMO), was one such person. He was the guy on...

Read MoreJune 10, 2011

We heard this week that Vanguard, the giant U.S. asset manager, is coming to Canada. As a permanent student of the business, I’ve been fascinated by Vanguard for many years. It’s an example of a company that grew through word of mouth. It went viral...

Read MoreJune 8, 2011

A 7-game playoff series is a unique animal. It’s a roller coaster ride with potential mood swings after each game. It reminds me a lot of investing actually. As I sit here with my Canucks jersey on, I feel like the boring realist. I’ve celebrated each victory and got pissed off after each loss, but in between, I've refused to get too caught up in the hyperbole. I've found myself in a few conversations that go...

Read MoreMay 27, 2011

“What I find of particular interest is the speed at which changes in communication technology are happening. It’s causing a great intergenerational knowledge gap, which is rather worrisome because many decision makers are still part of my old-fart...

Read MoreMay 13, 2011

Personal disclosure: I’m a dyed-in-the-wool active manager, but admit to having used exchange-traded funds in my portfolio. I’ve tread on the dark side for tax planning purposes and, occasionally, to hedge certain long-term positions. I also must...

Read MoreMay 4, 2011

There was news today that two private equity firms, Berkshire Partners LLC and OMERS Private Equity, are buying Husky International from Onex, another private equity company. This secondary buyout (defined as one private equity firm buying a company...

Read MoreApril 29, 2011

I’ve enjoyed watching the federal election campaign, but that’s where it ends. It will have no impact on markets (for more than a day), and my interest in being a public official has never been lower (it’s a brutal job). The office I’m interested in running for, however, is...

Read MoreApril 27, 2011

In this space, we’ve talked often about the conundrum cash-rich investors face. If they’ve been out of the market, or are sitting on a high proportion of cash, what do they do? This week there were some comments from Earl (the Pearl) Bederman at Investor...

Read MoreApril 25, 2011

How’s this for two totally different customer experiences. Recently I went into Sigge’s, a local cross-country ski store, to buy some equipment. I’ve been a ‘classic’ skier for years, but am increasingly feeling the pressure to keep up with my ‘skate skiing...

Read More